The client

Our client was Bank Millennium SA, part of a global Millennium group and modern bank, offering its services to all market segments through a network of branches, networks of individual advisors and electronic banking, with 7000+ employees and 3+ million individual clients.

The company aims to be a modern, digitalized bank, striving to become the most personalized bank in Poland thanks to advanced data solutions and prioritizing making customers’ daily lives more accessible by offering them convenient and intuitive access to financial and non-financial services.

The challenge

In today’s rapidly evolving financial landscape, banks face increasing regulatory pressure and growing expectations from stakeholders for transparent, secure, and well-governed data. To meet these demands, institutions need a coherent, organization-wide data strategy that ensures consistency, quality, and compliance across all business units. Implementing such strategy requires advanced tools capable of centralizing metadata, tracking data lineage, and providing clear visibility into data usage and ownership.

This was exactly the case at Bank Millennium, where the growing complexity of data sources and distributed information created the need for a consistent, centrally managed solution for data governance, with a particular focus on metadata management. At the same time, the bank had to meet strict regulatory requirements and demonstrate to KNF – the Polish financial market authority – that all security and governance standards were fully addressed.

These challenges manifested in several key issues that the bank needed to address:

- Distributed information without a common business glossary

- Ad-hoc reporting of data quality issues without adequate policies

- Risk of mismatch with banking market regulatory requirements

The solution

To support bank’s data strategy, we implemented Microsoft Purview as the cornerstone for metadata management, security, and governance. Purview was utilized to catalog data, track lineages, provide a comprehensive data map, enable robust access control, and facilitate automated data discovery and classification.

The project began with the construction of a metamodel aligned with the physical model. This included the business configuration of vocabulary, defining access levels, and assigning permissions. Leveraging the Workflows feature, we configured processes to:

- Add, edit, or withdraw business concepts.

- Manage timeliness and consistency through concept reviews.

- Synchronize the global and local dictionaries for seamless integration.

Data integration followed strict compliance with internal and external regulatory standards. Initial data ingestion, provided in XLS/CSV formats, was loaded into the Purview system to ensure a seamless start.

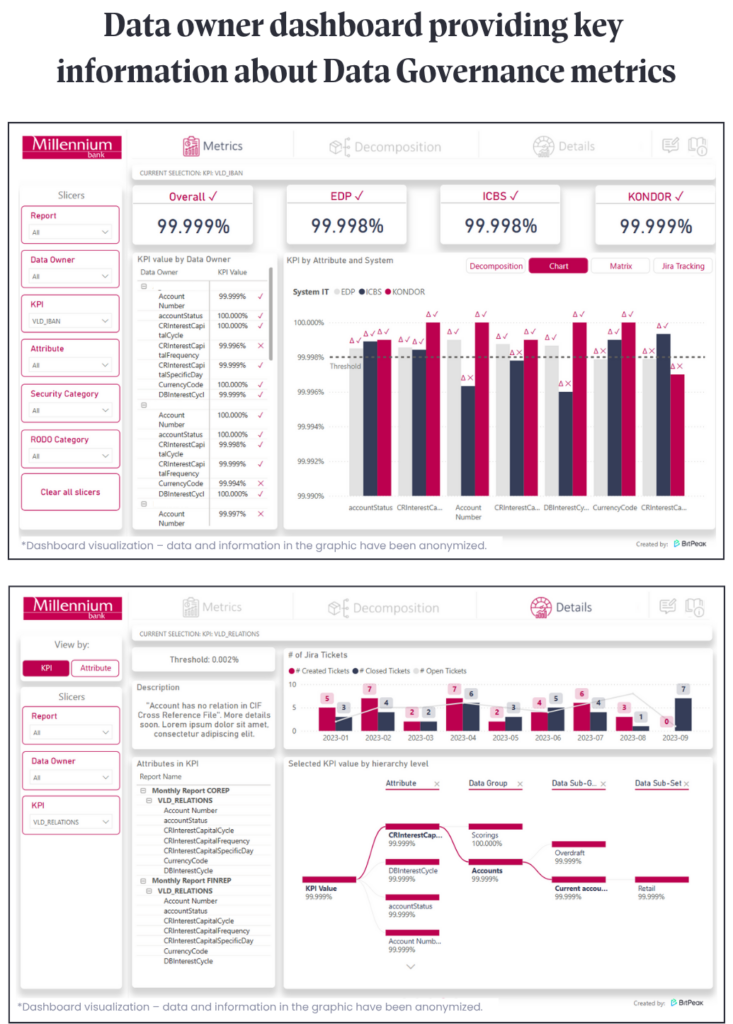

To empower data stewards, a Power BI dashboard was developed, integrating information from Jira, Purview, and an SQL database. This dashboard offered insights into KPIs such as data ownership, definitions of business concepts, and data quality metrics across various columns, bases, and areas. Users could visualize data lineages, usage, and dependencies, providing a holistic view of the entire data ecosystem.

Furthermore, the dashboard enabled direct ticket creation in Jira, assigned to relevant business groups, ensuring streamlined communication and issue resolution.

The final result was a comprehensive reporting tool, allowing users to explore business definitions, track data hierarchies from board members to data owners, and pinpoint low-quality data and the individuals accountable. This significantly enhanced the bank’s ability to manage data quality and governance effectively.

To reach our goal, we used the following tech stack:

- Microsoft Purview: main platform for data management and governance, used for classification, metadata management

- Python: automatization and data integration scripts

- Microsoft Azure: a cloud environment that hosts all applications and services related to the project

- Azure DevOps: continuous integration and Continuous deployment (CI/CD), source code management, and project progress monitoring

- Terraform: IaC management tool used to create and manage the configuration of the Azure environment

- Power BI: data visualization

Benefits

Regulatory compliance

During a previous security audit, a significant risk was identified regarding the lack of established procedures for data governance. The audit recommended the implementation of structured workflows and tools to address this gap. With the adoption of Microsoft Purview, Bank Millennium successfully met all relevant internal and external regulatory requirements, ensuring full compliance in managing and governing data.

Data strategy

The implementation established a unified, transparent, and secure framework for managing the bank’s data assets. By consolidating governance, classification, and access control in one environment, the bank gained full oversight of data quality and compliance processes. This centralized approach not only improved the efficiency of data-driven decision-making but also created a scalable foundation for future data initiatives and digital transformation projects. The solution ensures that regulatory, operational, and business objectives are aligned through consistent, organization-wide data management practices.

Operations

The Power BI dashboard delivered a single, interactive view of data quality, lineage, and ownership, integrating insights from Purview, Jira, and SQL sources. By automating monitoring and reporting, the solution streamlined daily operations and significantly reduced the manual workload of data stewards. Business teams can now quickly identify and resolve data issues, improving accountability and shortening decision cycles. The enhanced visibility across data assets strengthens collaboration between business and IT, supporting continuous improvement in governance and operational excellence.

(+48) 508 425 378

(+48) 508 425 378 office@bitpeak.pl

office@bitpeak.pl