Introduction

In recent years Environmental, Social, and Governance (ESG) went from a secondary concern or bullet point on a CSR leaflet to a key part of corporate strategies. Why?

There are many reasons from research indicating that sustainability is good for a company’s long-term success to legal obligations, criteria for cheaper financing, and better employee relations. Aligning business and ESG strategies is both a challenge to overcome and an opportunity to seize.

Fortunately, both of which can be simplified thanks to advanced data gathering, analytics, and reporting tools, which allow companies to monitor their supply chains, forecast ESG risks, and keep up with new regulations. In our series of articles, we will guide you through the whole process

Understanding ESG

Before we go further, let us make sure we are all on the same page, by answering the basic question. What exactly does ESG mean?

E stands for the environmental criteria, which consider how a company performs when preserving and mitigating the harm to the natural environment. This can mean:

- Renewable Energy Adoption: Companies investing in solar panels, wind turbines, or purchasing green energy to power their operations.

- Waste Reduction Initiatives: Implement recycling programs, reduce packaging materials, and promote reusable products.

- Sustainable Resource Use: Utilizing sustainable materials in production and adopting practices that reduce water consumption and prevent deforestation.

- Carbon Footprint Management: Engaging in carbon offsetting projects and striving for carbon neutrality through various environmental initiatives.

S stands for the social criteria, which assess a company’s capacity and performance in managing relationships with communities around it, employees, shareholders, or, simply put – stakeholders. For example:

- Fair Labor Practices: Ensuring fair wages, safe working conditions, and adhering to labor laws; promoting diversity and inclusion within the workforce.

- Community Engagement: Investing in local communities through philanthropy, volunteer programs, and supporting local economic development.

- Supply Chain Responsibility: Monitoring suppliers to ensure they adhere to ethical practices, including human rights and environmental standards.

- Product Responsibility: Ensuring products are safe, meet quality standards, and are produced ethically, including respecting customer privacy and data protection.

G represents the Governance criteria, which revolve around the rules, practices, and processes by which a company is directed and controlled. Governance in the ESG context focuses on how a company ensures that its operations are transparent, compliant, and aligned with the interests of its shareholders and other stakeholders. This involves:

- Board Structure and Composition: The effectiveness of the board in providing oversight, including its size, composition, diversity, and the independence of its members.

- Ethics and Compliance: The company’s commitment to ethical behavior and compliance with laws, regulations, and internal policies, including mechanisms for preventing and addressing corruption and bribery.

- Executive Compensation: How executive compensation is structured and aligned with the company’s long-term goals, performance, and shareholder interests.

- Risk Management: The processes in place to identify, manage, and mitigate risks that could affect the company’s business, reputation, and long-term sustainability.

- Shareholder Rights and Engagement: Ensuring that shareholders have a voice in important decisions through voting rights and other engagement mechanisms , and that their interests are considered in the company’s governance practices.

Why is ESG important?

Now we know what ESG is. But why should you care about it? Aside from ethical reasons.

The present relevance of ESG is underpinned by its integration into investment decisions, corporate strategies, and regulatory frameworks during the last few years.

For many bigger companies, those who are included in increasingly numerous sustainability regulations, ESG compliance is no longer optional, though for now, it is mostly focused on reporting and prevention of greenwashing, such as SFRD and CSDR. Even if they are omitted, they probably want to work with those who are or obtain financing from ESG-focused funds. Especially since some of the biggest financial management funds, such as Blackrock, steer increasingly in the ESG direction.

However, the question of the permanence of such direction persists as recently some moved away from sustainability-focused funds.

Sustainability factors can influence investor preferences, government grants, consumer behavior, and financing possibilities. Because of that ESG-compliant financial assets are projected to exceed $50 trillion by 2025, accounting for more than a third of the projected $140.5 trillion in global assets under management. This significant growth, from $35 trillion in 2020, reflects the increasing mainstreaming of ESG criteria into the financial sector and beyond.

The research also indicates that ESG funds outperform their less sustainable counterparts over both shorter and longer periods of time.

It is also worth noting that there is no “Too big for ESG”. Tech giants such as Amazon, Google, and Apple, have faced scrutiny regarding their ESG practices, especially in the social and governance aspects. This not only made them eat bad PR but also motivated regulators to take a closer look at them.

This means that the growth of ESG assets and the increasing integration of ESG criteria into business practices reflect a paradigm shift in the business and investment landscape. And as sustainable governance becomes more critical, companies are urged to adopt comprehensive strategies to meet new, evolving standards, and ensure that their operations align. Well, and report everything about that alphabet soups such as CSRD, or SFDR or CSDDD requires them to.

Knowing all that, let us ask about what new challenges will appear and how to make ESG strategy an asset rather than bothersome new obligations. We will start by identifying business and legal challenges and risks.

Business & legal – challenges and opportunities

First, let’s take on business challenges, which consist mostly of strategic and operational risks. For example, poor corporate governance can weaken risk management in ESG areas and across different parts of the business, leaving companies open to major strategy mistakes and operational problems, such as misalignments, missed investments and internal conflicts. As ESG regulations get more complex and wide-reaching, companies need a comprehensive strategy that embeds ESG governance throughout their operations. This approach helps ensure everyone is on the same page and reduces the risks of disjointed ESG efforts.

Then we have dangers to reputation. The impact of failing to address ESG issues can be considerable. Almost half of investors are willing to divest from companies that do not take sufficient ESG actions, highlighting non-compliance’s reputational and financial risks. Well, at least half of the investors self-report that way. Additionally, consumers are more willing to buy products from companies without ethical standards, while employees stay longer in companies that care for their well-being!

Secondly, we have financing opportunities.

As we established earlier, investors are often more willing to invest in sustainable companies. But that is not all when it comes to ESG and financing.

Many companies now favor green bonds or ESG-linked loans to fund projects that are good for the environment, getting a better deal terms such as higher principal or lower interest rates thanks to high demand from investors who want sustainable options.

Additionally, governments and regulatory groups are getting involved too, offering grants, subsidies, and incentives to push companies towards sustainable practices. This financial aid makes it more appealing and financially feasible for companies to pour money into green projects and social efforts. On top of that, sustainable investment funds are funnelling money into companies known for their solid ESG practices, providing an often cheaper alternative to the usual financing methods.

Lastly, we have the carbon credits market, which gives companies a financial incentive to cut emissions, letting them sell any surplus credits or balance out their own emissions, effectively paying them for being eco-friendly. It is also worth noting that regulatory incentives and partnerships between the public and private sectors often include ESG objectives, nudging companies to take on public benefit projects while sharing the financial and operational load.

Many legal regulations focus on ESG criteria. So, we will point them out to underscore their scope without an in-depth look. The third article in the series will focus on legal obligations and ways to manage them more easily.

EU:

- Corporate Sustainability Reporting Directive (CSRD):

- Sustainable Finance Disclosure Regulation (SFDR)

- EU Taxonomy Regulation:

United States:

- SEC’s Climate Disclosure Proposal

- Climate-Related Financial Risk Executive Order

Asia:

- China’s Green Finance Guidelines

- Japan’s TCFD Consortium:

- Singapore’s Green Finance Action Plan

Optimizing ESG processes with data

After outlining the future challenges, we can talk about things that we at BitPeak specialize in! That means solving problems with data. But let’s talk specifics, how can we use new technologies, AI, Data Engineering and Visualizations to make future more sustainable?

Data collection and management

The most essential things regarding sustainability initiatives and regulatory ESG compliance are accurate reporting and information management. Usually, the process can be complex due to the multitude of different standards and high complexity of operations in enterprise-scale companies. However, it can be made easier with environmental management information systems, which can aid in accurately reporting greenhouse gases, compliance reporting, and tracking product waste from generation to disposition.

To illustrate, we can look at projects utilizing no-code platforms for ESG data collection and reporting. Its goal is to address the challenges of fragmented and geographically dispersed data for ESG compliance, which many companies, especially those with many global branches, struggle with. By developing a workflow-management tool that automates communication with data providers, digitizes data collection, and centralizes tracking and approval statuses, operational risks and errors can be significantly reduced while the reporting cycle is shortened. Read more here.

Analytics and reporting

The need for robust, auditable ESG data has never been more critical, especially with the SEC’s proposed climate disclosure rules. Organizations are moving beyond static Excel spreadsheets, utilizing real-time ESG data management software to manage compliance obligations and beyond. This approach facilitates compliance and delivers higher business value, sustaining a competitive advantage by investing in ESG initiatives. Sounds interesting?

Think about the possibilities with dynamic and scalable dashboards that quickly show you what areas you are ahead and where you lag behind the demands of regulators and investors. Take a look at our showcase of GRI compliant ESG report right here as a perfect example of this approach: BitPeak ESG Intelligence tool

AI and Machine Learning

AI-based applications offer new ways to enhance ESG data and risk management. For example, ESG risk management solutions use machine learning to streamline regulatory compliance management. They analyze complex requirements and produce structured documents highlightning key elements organizations need to meet their obligations, thereby facilitating compliance.

Especially with the advent of recent solutions based on the idea of RAG (Retrieval Augmentation Generation) and semantic knowledge bases! Being able to always easily access just the right information from internal sources or insights about coming regulation with one question to a specialized and fully secure language model is simply an implementation issue.

Predictive analytics for ESG risk management

Data science techniques, specifically predictive analytics, can also be used to identify and mitigate sustainability risks before they become problematic and harder to mitigate. Firms can predict potential vulnerabilities using data models that incorporate various indicators such as historical financials, ESG performance metrics, and even social media sentiment.

For example, Moody’s Analytics ESG Score Predictor employs a proprietary model to estimate ESG scores and carbon footprint metrics, providing insights for both public and private entities across a multitude of sectors.

Optimizing operations with data tools

But reporting and predicting, while important, is not the be-all and end-all. So let’s take a look at how the integration of IoT and advanced data analytics can be used to reduce environmental footprint. IoT sensors deployed across various segments of operations, from manufacturing floors to logistics, gather real-time data on energy use, waste production, and resource consumption. This data is then analyzed to pinpoint inefficiencies and adjust processes accordingly, leading to significant reductions in energy consumption, waste, and overall environmental impact.

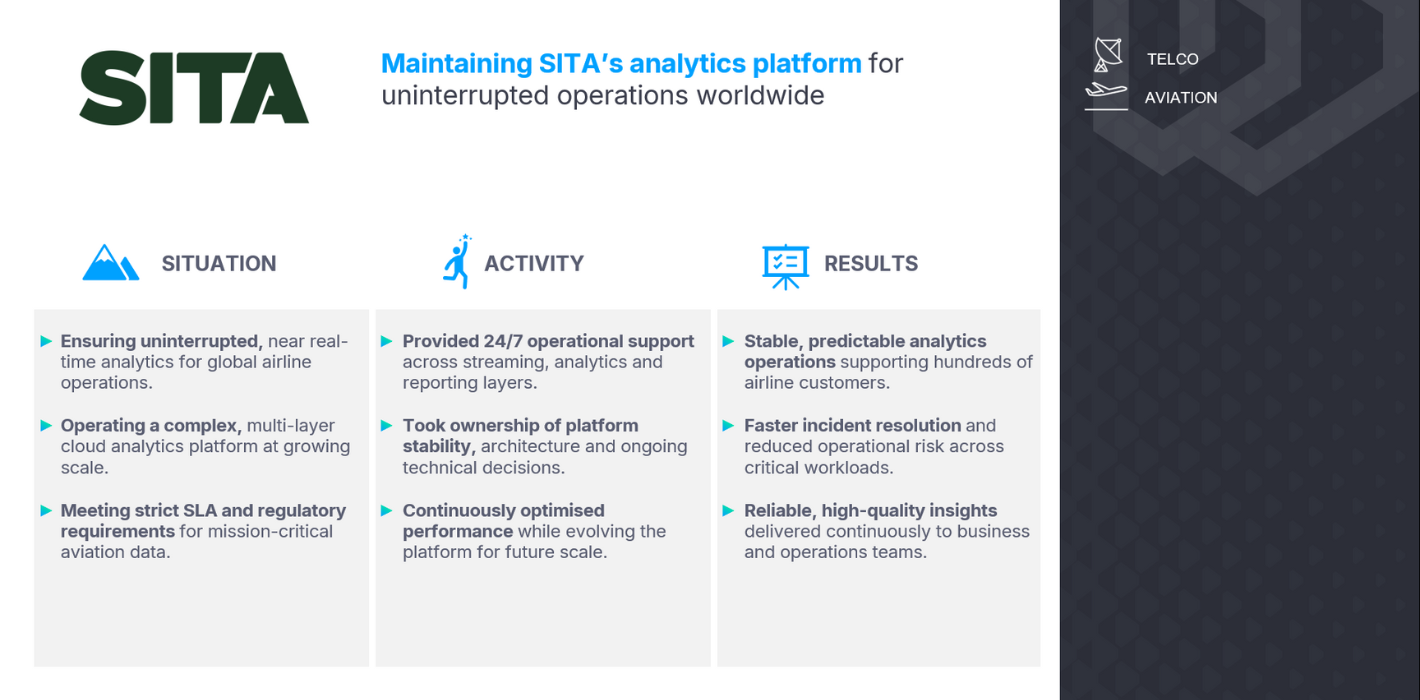

A fine example of this is BitPeak’s project during which we cooperated with SiTA to optimize fuel usage in air travel as well as SAF (sustainable aviation fuel) logistics, while ensuring compliance with EU SAF targets! Another practical application of this approach can be seen in smart manufacturing facilities where IoT sensors control and optimize energy use, substantially lowering operational costs and reducing carbon emissions.

As you can see there are a lot of ways and tools to not only make ESG compliance easier, but also more profitable, which is the key to the green future. As regulations and market trends continue to move towards the sustainability, leveraging new tech will be key to maintaining both integrity and competitive advantage in the business landscape.

Conclusion

So, what’s now? We have discussed what ESG is, why you should be interested in it and ways in which data can help you with legal compliance and aligning your business and sustainability strategy. We discussed ESG’s growing importance due to stakeholder, and financer demands for sustainable business practices and identified challenges in ESG compliance, including strategic, operational, and legal hurdles.

We highlighted IT solutions like our GRI compliant report or AI which analyzes ESG performanceand helps you meet ESG criteria. In the end we want you to leave knowing that leveraging data technology is crucial for businesses to navigate the complexities of ESG compliance efficiently. But that is not all! We also plan to write an article exploring the way to design and implement optimal and efficient Power BI dashboard to deal with your ESG and sustainability reporting needs! Look forward to it appearing on our blog soon!

All content in this blog is created exclusively by technical experts specializing in Data Consulting, Data Insight, Data Engineering, and Data Science. Our aim is purely educational, providing valuable insights without marketing intent.

(+48) 508 425 378

(+48) 508 425 378 office@bitpeak.pl

office@bitpeak.pl