Banking is one of the key areas of our work, so it was only natural for BitPeak to be part of this year’s IT@BANK 2025. As a partner of the event, we had the chance not only to join insightful panels and discussions on data-driven banking, AI-powered innovation and the future of digital finance, but also to continue these conversations at our own stand. Here is our take on the most interesting highlights from the event.

Directions: AI and security

This year, AI was unquestionably the central theme of the conference, highlighted in almost every panel and discussion throughout the day. Speakers emphasized that the future of banking will be shaped by the ability to turn data into actionable, AI-driven insights. From process automation to predictive analytics and personalization at scale, AI was presented as a catalyst for both operational efficiency and customer experience.

AI, however, cannot thrive without a strong cybersecurity foundation, and this message resonated just as strongly during the event. With financial institutions facing increasingly sophisticated threats, experts stressed the need for a modern, multilayered approach to security and resilience. Discussions covered regulatory expectations, cloud security, supply chain risks and the rising role of human-focused attacks.

Without a doubt, one of the highlights of the conference was the keynote delivered by Krzysztof Gawkowski, Deputy Prime Minister and Minister of Digital Affairs. He emphasized the strategic importance of data for the digital economy and the potential of Poland’s AI ecosystem. He also reminded that technology must ultimately serve people, reinforcing the idea that AI development should always be grounded in transparency and trust.

Inspiring conversations at BitPeak’s booth

The BitPeak booth quickly became one of the liveliest meeting points of this year’s IT@BANK, where our experts spent the day discussing data strategy, AI readiness and the practical challenges banks face in transforming their organizations. It was a space for deep-dive conversations, spontaneous questions and hands-on exchanges that went far beyond what fits into panel discussions.

Here is what our team highlights as their key takeaways from conversations:

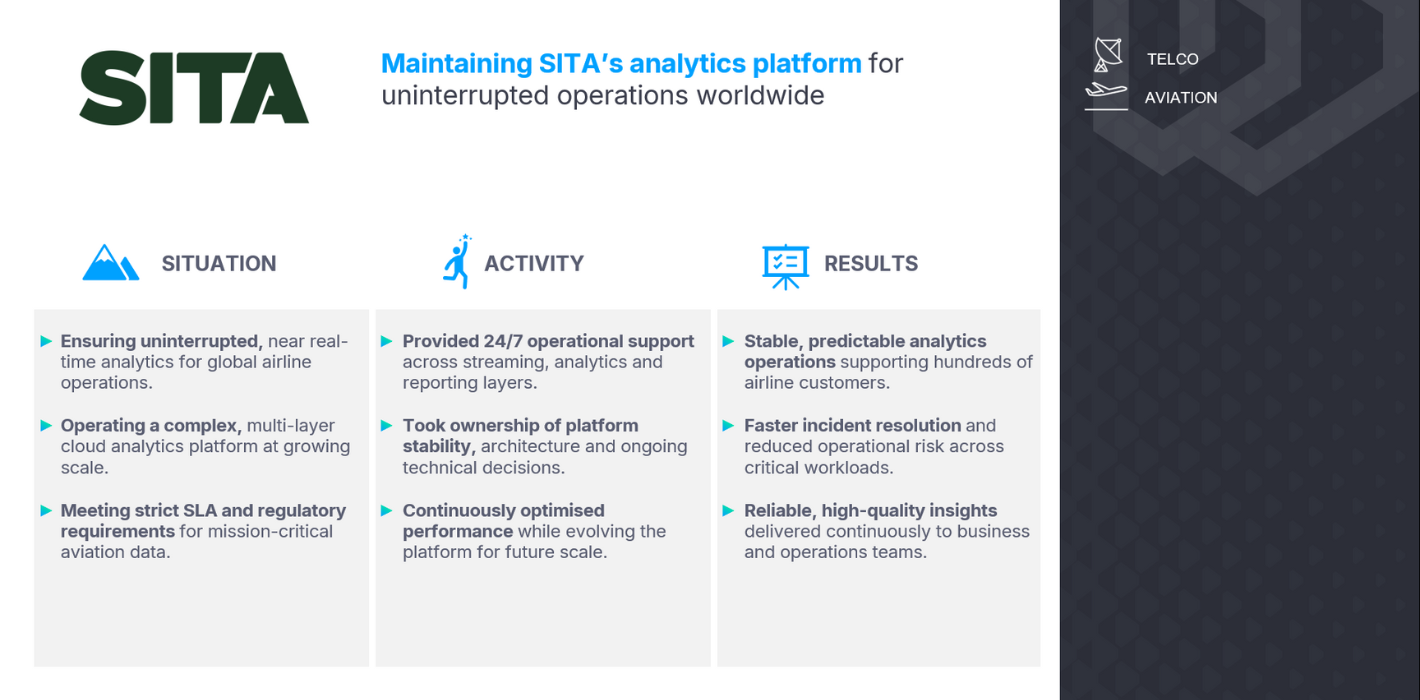

“Regulatory topics such as JPK_CIT reporting came up frequently, which reflects what I also see in projects like MCOV and SBP,” says Michał Kołodziejski, Consulting Manager. “There was also strong interest in practical AI use cases and how challenges from other industries, like aviation, can translate into banking. What stood out to me most was the need for solid data foundations, because without a flexible, scalable platform with proper governance, neither AI nor regulatory compliance can be delivered effectively.”

“In many discussions, I heard a clear demand for very specific AI-driven use cases,” says Andrzej Chuść, Senior Business System Analyst. “Examples ranged from behavioural analytics for privileged-access monitoring, through product pricing models and churn prediction, to real-time AML processing with millisecond-level latency. Even the more traditional areas, like regulatory reporting, are now expected to evolve with AI at their core, which strongly echoed the themes raised in the opening keynote.”

CEO’s insights on AI strategies

In addition to the many discussions and presentations at IT@BANK 2025, the insights extended beyond the conference halls. A special edition of Miesięcznik Finansowy BANK brought together expert commentary and strategic perspectives from across the sector, including an article by our CEO, Sebastian Kamiński. His contribution offers a clear and practical view of what truly determines the success of AI initiatives in banking.

Sebastian highlights that implementing AI requires more than advanced technology and that its real value emerges only when supported by a coherent strategy, strong data foundations, and transparent governance. Many banks still approach AI as isolated pilots rather than scalable capabilities, which limits their long-term impact. Responsible AI is not only about regulation but about building transparency and trust, ensuring that new solutions strengthen the relationship between banks, customers, and employees. You can read Sebastian’s article here (available in Polish only).

If you have not had the opportunity to meet us at the conference, don’t worry! Write to us – let’s talk about data.

BitPeak

Value from Data

(+48) 508 425 378

(+48) 508 425 378 office@bitpeak.pl

office@bitpeak.pl